Contents:

From the Account drop-down list, select an expense category. From the Payee drop-down, you need to choose a respective payee. Use the attachment function to upload the Settlement Statement to the Journal Entry. Your files will then be attached, so you don’t have to dig through your file cabinet next time you need to see them. Check with your accountant for more information.

In https://bookkeeping-reviews.com/, you can record all your cash purchases and you can maintain all your data effortlessly. For buildings, I recommend using the address or a parcel number for unique identification. If you would like to track depreciation, check the box here. In this article, we will discuss best practices and walk you through the steps to record the purchase of a fixed asset in QuickBooks. First, let’s begin with defining a fixed asset.

Services

Users and businesses might make many cash payments each day. You may record payments in QuickBooks so that you can quickly recall the amounts that you have paid out to customers, people, vendors, etc. QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed all offer this feature.

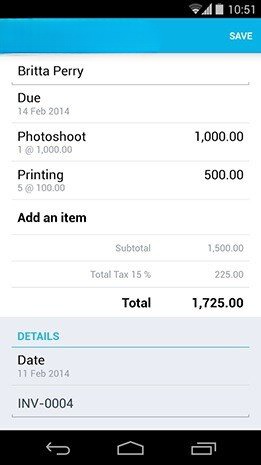

You will see New(+) when you will open the software. You can click on it and then you can provide all the details of the payments or expenses. After completing save this information and doing this you will able to record the cash payments in QuickBooks Online. On the left in QuickBooks one needs to click the menu, when one has already received the invoice. Now you have to click on the transaction button. After this, you have to pick the add transaction button.

Thus, now that you know how to record cash purchases in QuickBooks, hop on for it to ensure all your data is tactfully recorded. Now, these are the closing steps and in this, you will see how to record a cash payment to a vendor in QuickBooks Online. From the options given, choose the type of bank account. As said, a lot of petty cash transactions might be involved in your daily business activities. Recording it or managing it in your books, might not sound or feel necessary at times.

How to Record Cash Purchases in QuickBooks Easily

You can track how much of a retainer or deposit you are holding for each customer from the Balance Sheet report. Quick Tips Thursday-Invoicing Hello Community! Are you struggling to get customers to pay you on time, or… Then, what is this New purchase, an Asset sale, an Entity purchase, etc. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

Otherwise, select your main operating account. From the Transfer Funds To ▼ dropdown menu, select your operating bank account. Some businesses receive retainers or deposits from customers before performing any services. When they invoice customers for services, those invoices are paid using the money from the deposits. You might sometimes want to keep the details of your cash receipts in addition to cash payments. However, when you would be sitting to filing for your taxes, these type of transactions or cash expenses might get missed due to which it might result in overstating your income.

Loans, escrow, earnest money deposits, and closing cash

We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues. You can export a Chart of Accounts, Customers, Items, and all the available transactions from QuickBooks Desktop. Now select the Save option in order to store it in your particular PC. Add the details concerning the transaction like date, category, amount, anything.

Fixed assets cannot be easily converted into cash. For example, stocks, bonds, and other long-term investments are not fixed assets because they can easily be converted into cash. In general, except for land, fixed assets can be depreciated. In accounting, fixed asset accounts appear on the company balance sheet. Find each of these lines on your closing statement and add them up. To add this total to your journal, you will need a fixed asset account for capitalized closing costs.

First of all, Click the Import available on the Home Screen. For selecting the file, click on «select your file,» Alternatively, you can also click «Browse file» to browse and choose the desired file. You can also click on the «View sample file» to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields.

Add New Fixed Asset Account

When the payment has been completed to clear the invoice, you can enter the invoice’s details. In QuickBooks Online, cash payments can also be recorded using the Expense option. Moreover, you can create a single Vendor profile and report the payment total. One can keep track of all the company’s financial transactions with the use of QuickBooks Online by entering cash payments through the Expense option.

What Is a HUD-1 Settlement Statement? – Forbes Advisor – Forbes

What Is a HUD-1 Settlement Statement? – Forbes Advisor.

Posted: Fri, 09 Sep 2022 07:00:00 GMT [source]

First, create two new accounts that will be needed for recording the purchase of a commercial property in QuickBooks. The expense reduces your liability account and your chosen bank account without affecting any of your business expense accounts. When you charge a customer for the services you perform for them, you can turn the retainer or deposit you previously received into credit on an invoice and receive it like a payment.

An invoice can have a zero total, but not a negative one. Instead of creating Sales receipts , you can invoice customers. Select an option from theWhen do you want to start tracking your finances from this account in QuickBooks? Select an option from theWhen do you want to start tracking your finances from the is account in QuickBooks?

We walked away from a potential acquisition after our add a bill you have received in xero period and therefore lost our Earnest Money Deposit. How do I record this loss/clear this in Quickbooks. Right now I have $1000 sitting in my Earnest Money Deposits account.

A Guide To Probate In Real Estate – Forbes

A Guide To Probate In Real Estate.

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

Cash payments to vendors can also be included in the accounting software in addition to this. Below, you will see the steps of how to record cash payments in QuickBooks Online. From the Deposit to ▼ dropdown menu, select the separate trust liability bank account you created, your main operating account, or the account this money will be kept in.

Sobre el autor