This infographic template can be customized with your own company information. You can also edit and use it to share your company’s progress or history with potential clients. Branded Templates new Get a bundle of templates that match your brand. Get our blog alerts Stay connected to the latest mortgage insurance news, trends and expert insights with timely email alerts. Rounding out the list are businesses related to astrology and veganism.

Templates, customize if needed and download, present or share your work straight away. Download as a high resolution JPEG, PNG, PDF or HTML5, embed into a blog post or webpage, or generate a shareable link for online use. Why partner with us Year after year, customers value working with us. Reach first-time homebuyers Discover how our homebuyer education program can connect you with more potential borrowers.

Mobile Gaming Trends Infographic

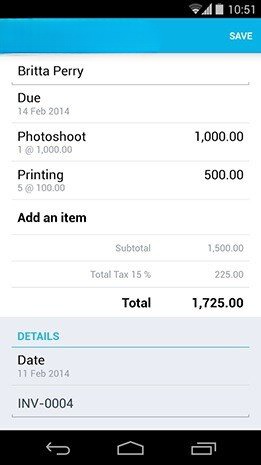

Modern Restaurant https://bookkeeping-reviews.com/ would like to store your above information when you create an account. We will not share this information with third parties and you can delete your information from our system at any time. Optimize partner lifecycle management at every stage of ecosystem growth. We’re always producing new content to help businesses understand economic trends and navigate trade uncertainty.

No longer do you need to be a graphic what forms a good business teamer with years of experience under your belt to design captivating, compelling infographics in a fraction of the time it used to take. Highlight the growing industries with this professional and educational anatomy infographic template. Thefive infographicsacross the app categories measured show some surprising results. If you need to educate your audience about your product or service, persuade them to buy, or influence their behavior, then you need to incorporate infographics in your brand marketing.

How to Grow a Poem From a Seed-Infographic

And in one of those bags you will always find a half finished book she’s been struggling with for months. Turn your conventional lists and bullet points into a visually appealing infographic using this template. Educate, optimize and streamline your lending process with MGIC’s vast library of tools, resources and marketing materials. To help narrow down your search efforts, I’ve put together a toolkit of some of my favorite no-code growth tools that marketers can benefit from using. Teens and young adults spend huge amounts of their time consuming online video, and that trend will not turn any time soon.

Video-on-demand traffic will double by 2022, and high definition will be 70% of this. Consumer internet video traffic is 80% of all internet traffic across the world. Video will be the primary medium for how internet users will consume information.

Supporting teachers and reformers in higher education through encouraging serious engagement with the scholarship on teaching and learning. Download our newest white paper and learn the difference between working with a Micro-Influencer vs. Everyday Fans and how each can be leveraged to support your advocacy marketing and influencer marketing efforts. Quality tips, actionable strategies, guides, industry chatter and just overall marketing goodness. Type 2 diabetes is a progressive condition that leads to serious health consequences if not effectively managed, including blindness, kidney failure, heart attacks, stroke and lower limb amputation. Effective management at each stage can postpone or avoid these severe consequences — and medical technologies can play an important role throughout the management journey.

SlideTeam has published a new blog titled «Top 10 Projektmanagement-Workflow-Vorlagen für effiziente Unternehmen!». Dribbble is the world’s leading community for creatives to share, grow, and get hired. Loan servicing guide Quickly review the guidelines, requirements and submission options you need to service your MI-insured loans.

- To get started with ordering MI and servicing assistance from MGIC, begin with a review of our submission options and helpful resources.

- No regardless of the type of company you want to launch, here are nine tips to help you start your own company successfully.

- And in one of those bags you will always find a half finished book she’s been struggling with for months.

- Infographics are a powerful tool for capturing the attention of your target audiences.

The company bases the results on the number of contests and projects being generated on its platform by businesses in each sector, compared year-over-year and to the previous five years. The data-based results give some interesting insights into what businesses could become a larger part of the cultural conversation in the coming year. The 2018 study, for example, predicted cryptocurrency, cannabis, non-traditional travel and virtual reality companies would likely see high growth that year. Here’s the full infographic bringing together all the aspects of video marketing. This Millennial generation is set to become the dominant consumer group as Baby Boomers retire in their masses over the next few years.

If you can’t find the perfect template for communicating your science, you can count on our on demand service. All for presentation templates made specifically for you by professional designers and curated by our science team. The Tomatos grow is a great option to highlight your paper’s main subject straight away. Illustrate your science, spread your knowledge, and reach a greater audience with the power of infographics. Download the Technology Grow Infographics template for free and use in your technology infographic design. Decide what you want your infographic layout to look like, choose a color scheme and insert your content.

Report: Two Planes That Nearly Collided On Runway Were Both Cleared For Takeoff, Landing

Photo Effects Tool Wide range of AI image tools to repair and improve photos. Presentations New Create impressive PowerPoint and share it online. When autocomplete results are available use up and down arrows to review and enter to select. ’Stages’ here means the number of divisions or graphic elements in the slide. For example, if you want a 4 piece puzzle slide, you can search for the word ‘puzzles’ and then select 4 ‘Stages’ here.

- To learn more about mobile payments and LECs, download a free sample report of this year’s FutureBuy study for the United States.

- These investments will also serve as insurance to help them cope in the face of ongoing market uncertainty.

- If you want to learn more about how you can incorporate infographics in your marketing materials, reach out to me at

- Highlight the growing industries with this professional and educational anatomy infographic template.

So Millennial generation will become a key consumer group for brands to focus on. After watching a video, 64% of users are more likely to buy a product online. Adding a product video on your landing page can increase conversions by 80%. Inform and activate partner networks via newsletters and social media marketing. Even though we’re well into the era of social networks, VR, and wearables, the grand-digital-daddy communication tool, the humble email, is still one of the top tools for reaching your current and potential customers.

Amplify channel marketing efforts intelligently, driving more leads with less work. As with all measurements of human activities as complex as teaching and learning, the specific numbers provided above are subject to legitimate debate among researchers and may have shifted somewhat since the studies were conducted. MedTech Europe is the European trade association representing the medical technology industries, from diagnosis to cure. Learn more about the challenge of T2 diabetes in Europe and the role of medical technology in our latest infographic . Take a look at the infographic below from GfK’s latest FutureBuy® report to find out more.

MILITARY: World nuclear forces set to grow infographic – Graphic News

MILITARY: World nuclear forces set to grow infographic.

Posted: Mon, 13 Jun 2022 07:00:00 GMT [source]

You’ll get your point across more quickly and effectively than by simply using text alone. Highlight the growing impact of blockchain on different industries with this infographic template. Share industry trends for the benefit of your audience using this eye-catching infographic template. Use this infographic template to share the blueprint of success in the media industry. Illustrate trends in data with visual graphs using this popularity trend infographic template.

Design compelling infographics with our selection of premium infographic templates. Edraw allows you to visualize infomation with professional infographic design. Get people excited about growing industries, or check out thousands of other infographic templatesto find one that works for your needs. I’ve tried and tested dozens of automation tools, and have even built a few of my own, with a singular focus in mind – finding easier ways to reach qualified leads that convert into paying customers. As a serial entrepreneur constantly searching for new ways for businesses to grow, I’ve spent more than a decade examining emerging consumer trends.

Infographic: Five Ways to Grow Your Email List Without Blowing Your Budget

The result was a revelation of which brands transcended expectations and went beyond their growth potential, including many lesser known brands that outperformed their brand funnel. While we wait until July to find out how brands actually performed in terms of app installs, the growth potential was captured in a consumer survey conducted in April at the beginning of the quarter. Today’s restaurant brands have to bridge the physical and digital divide, providing quality food and customer service while also meeting the needs of a digital-first world. This infographic template can be customized to create a design that fits your need. You can edit content, replace image, change colors, add or remove design blocks and more.

What industrial metals does the world mine most – from lead to … – World Economic Forum

What industrial metals does the world mine most – from lead to ….

Posted: Mon, 24 Oct 2022 07:00:00 GMT [source]

I understand that the data I am submitting will be used to provide me with the above-described products and/or services and communications in connection therewith. After an entrepreneur comes up with a business idea, one of their first tasks is to figure out a logo and how they want their brand to look. A modular enterprise operating model enables IT leaders to proactively steer their business toward growth opportunities regardless of ongoing market uncertainty. This infographic will help leaders identify business capabilities that need to frequently change to keep pace with shifting market demand.

Whether it’s a manufacturing process, a lifecycle demonstration or a corporate timeline, presenting the information graphically makes it much easier to digest content. When presented in paragraph form , data and trends can still be difficult to analyze. Infographics allow you to show multiple statistics together in a way that is clear and simply laid out, which makes your data/message more impactful. We care about your success with visual communication and scientific education. Many people started a corporation believing that they are going to turn on their laptop or open the door to earn money. They might end up to realize that it is quite difficult to get a company off the ground and just as difficult to continue to develop a company once it’s developed.